- No products in the cart.

“Rough Diamonds to be Discovered”, Carlos Durán in an interview with Dubai’s “Chic Icon”.

Interview by Luís Campo Vidal for “The Chic Icon”. Dubai, December 30th, 2020.

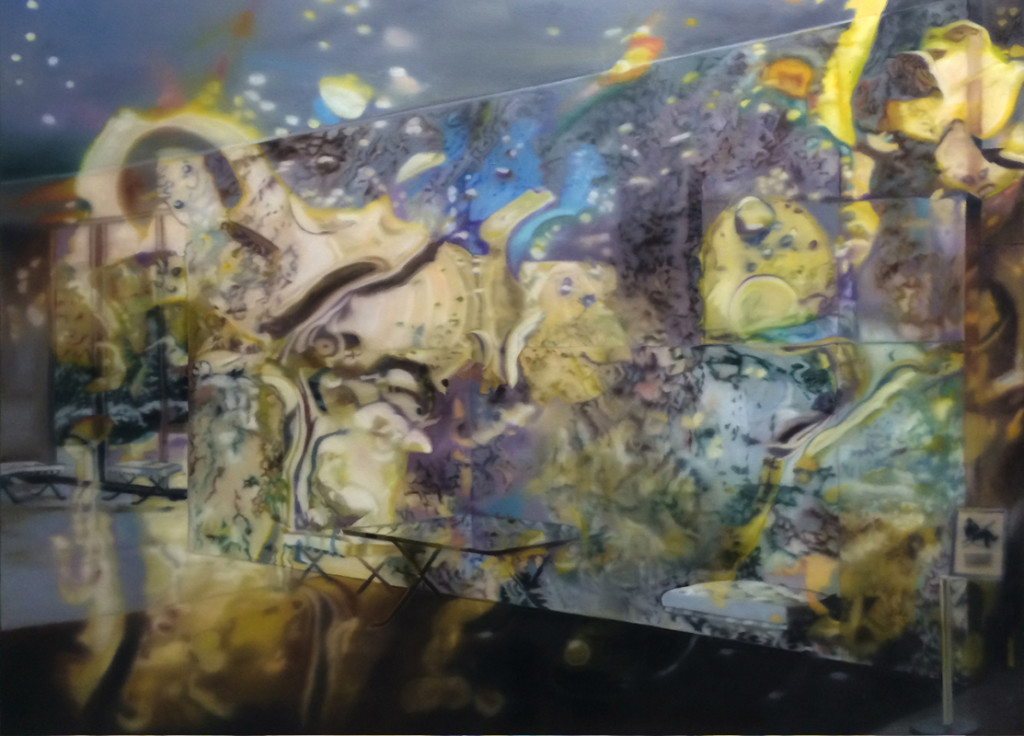

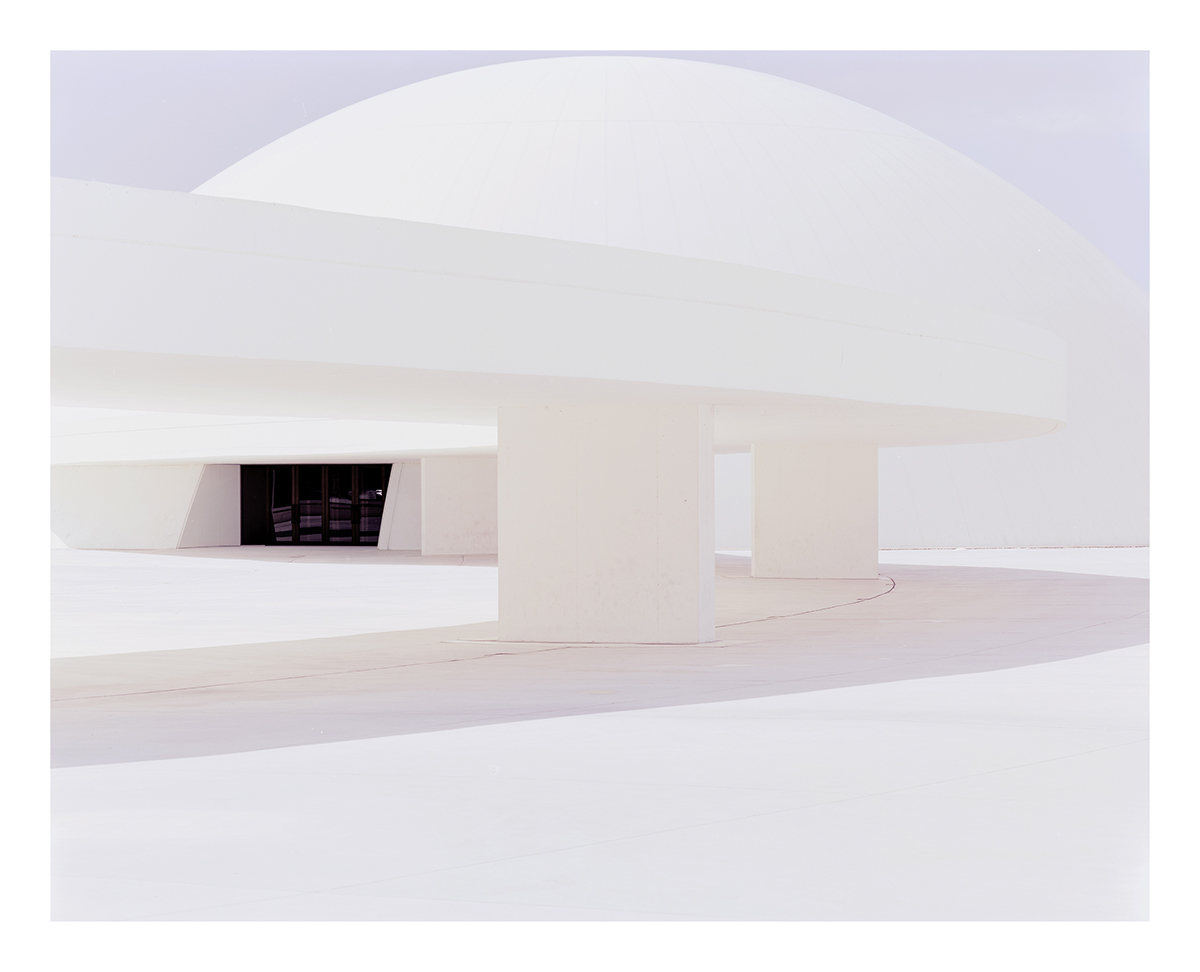

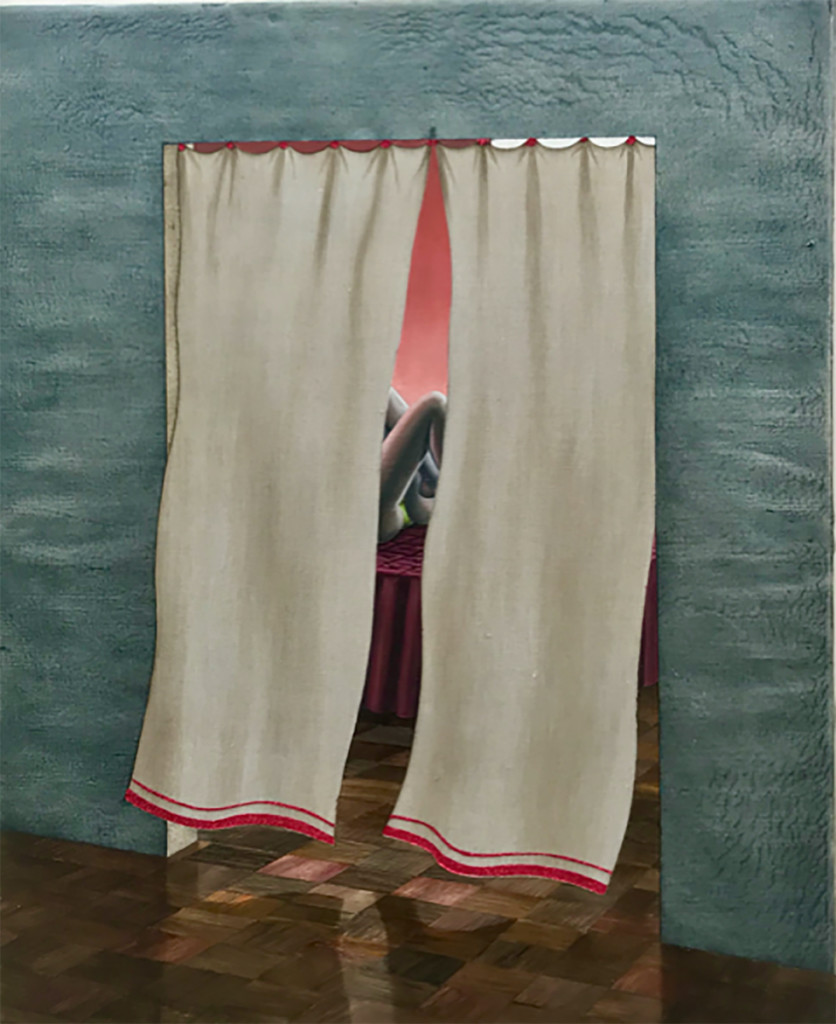

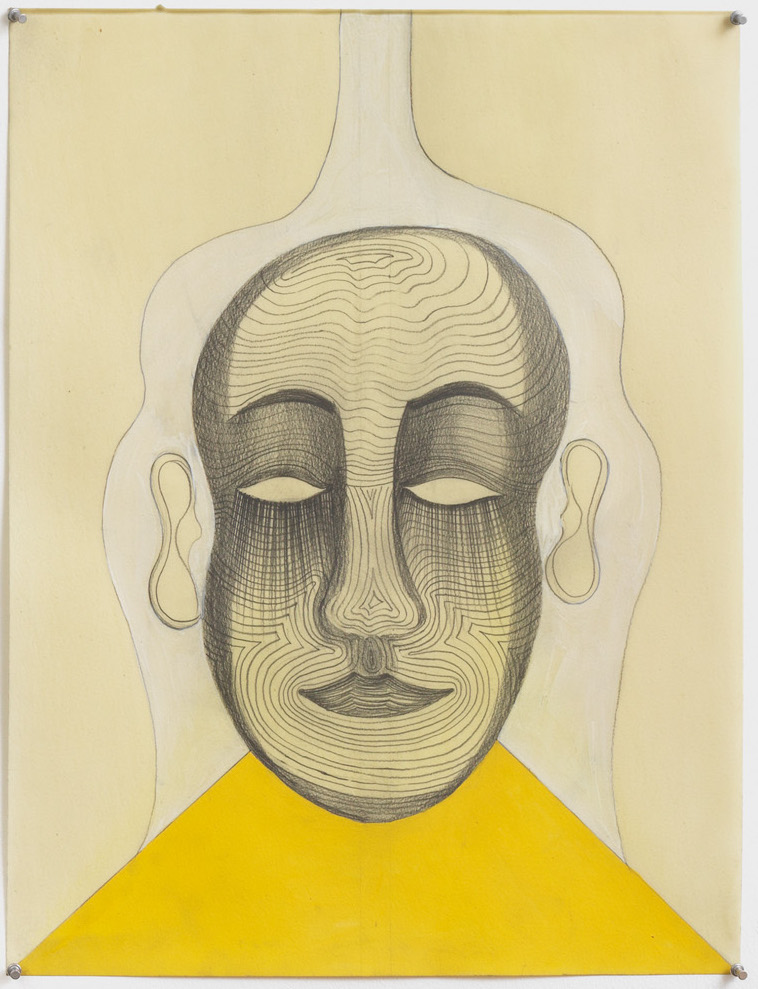

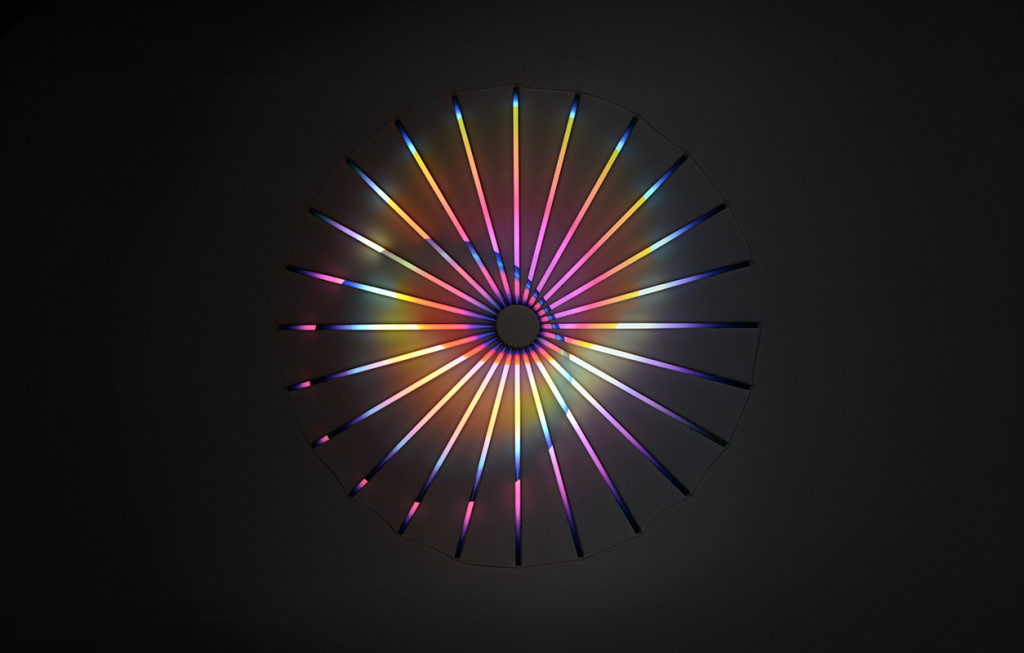

CÍRCULO ECUESTRE, one of the most traditional private clubs of greatest reputation in Europe, and a key institution in the professional and private life of the most prominent and influential personalities of Barcelona’s society, has transformed its impressive palace in the center of the city into a temporary museum for a week. “By Invitation”, a contemporary art fair, has been an imaginative and forceful response to a difficult year for everyone, including the arts’ area.

It is not an easy task to bring together 17 Barcelona’s art galleries and collude them to co-create this temporary museum, enriched with a cycle of colloquiums in which collectors, art consultants, journalists and gallery owners share their opinions. The organizers of this first contemporary art fair in Barcelona deserve to be congratulated for their outstanding initiative.

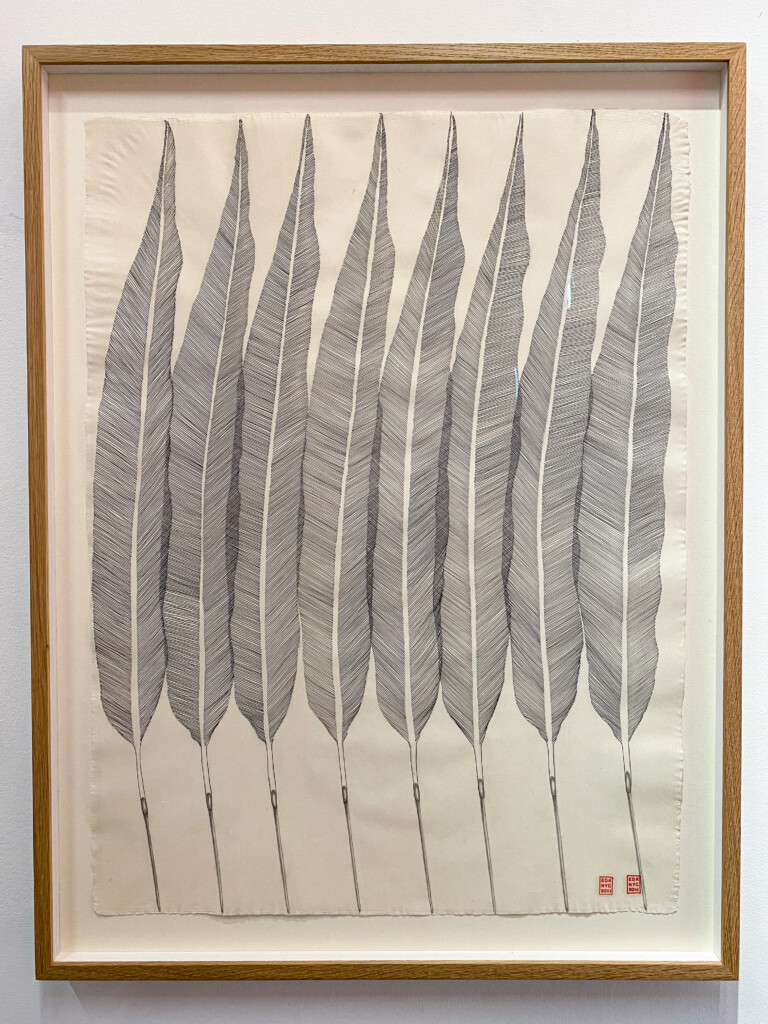

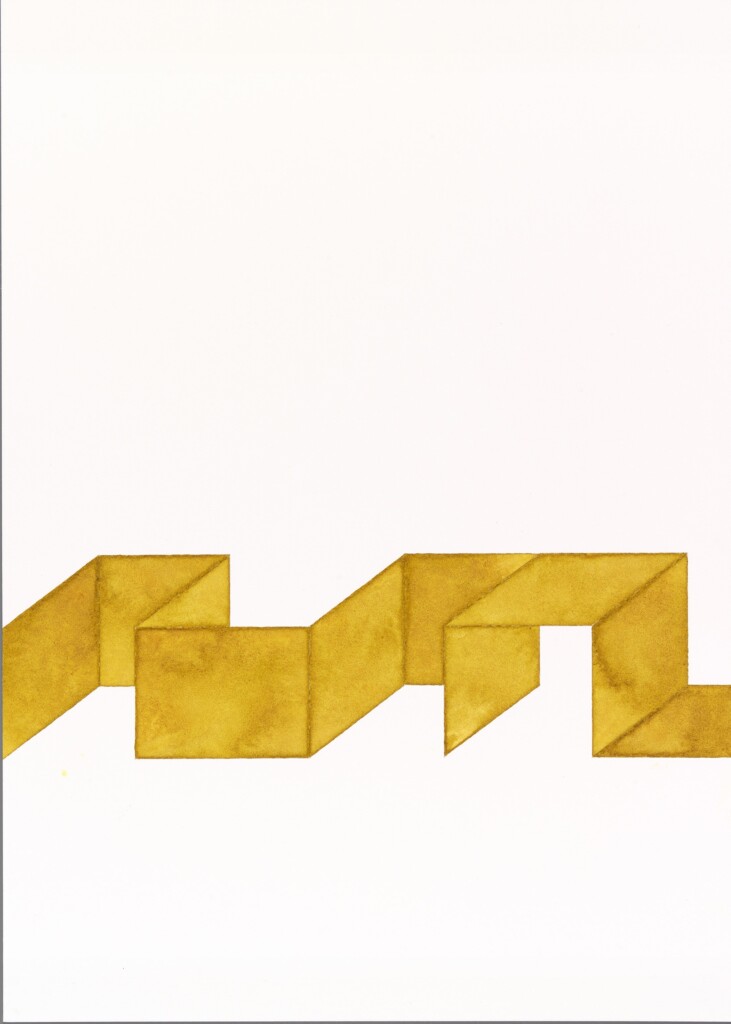

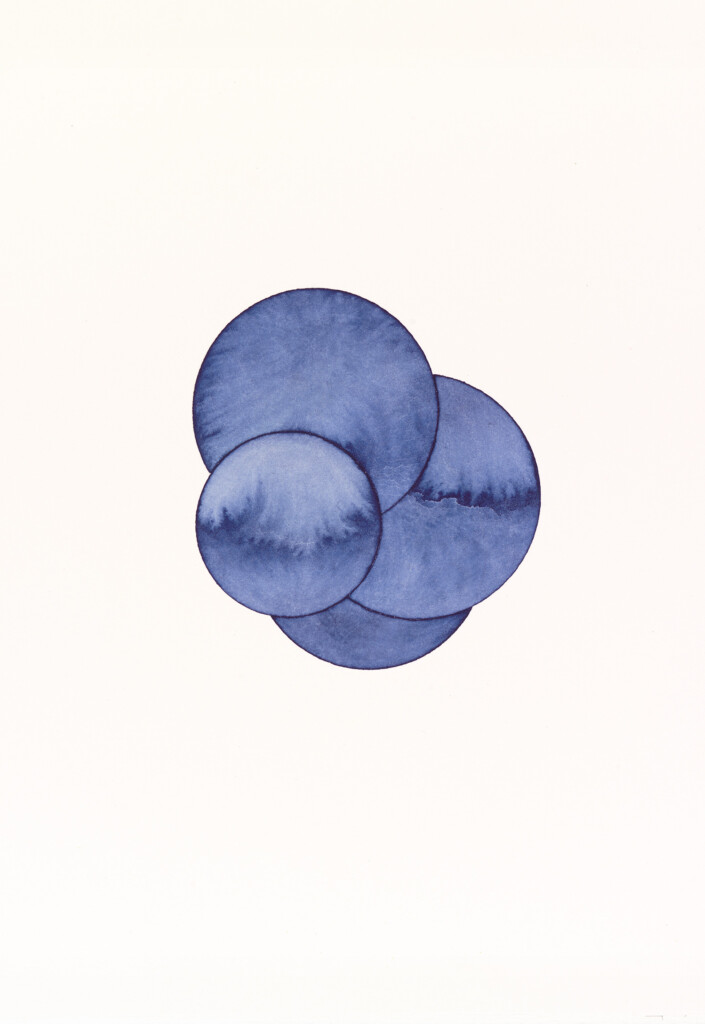

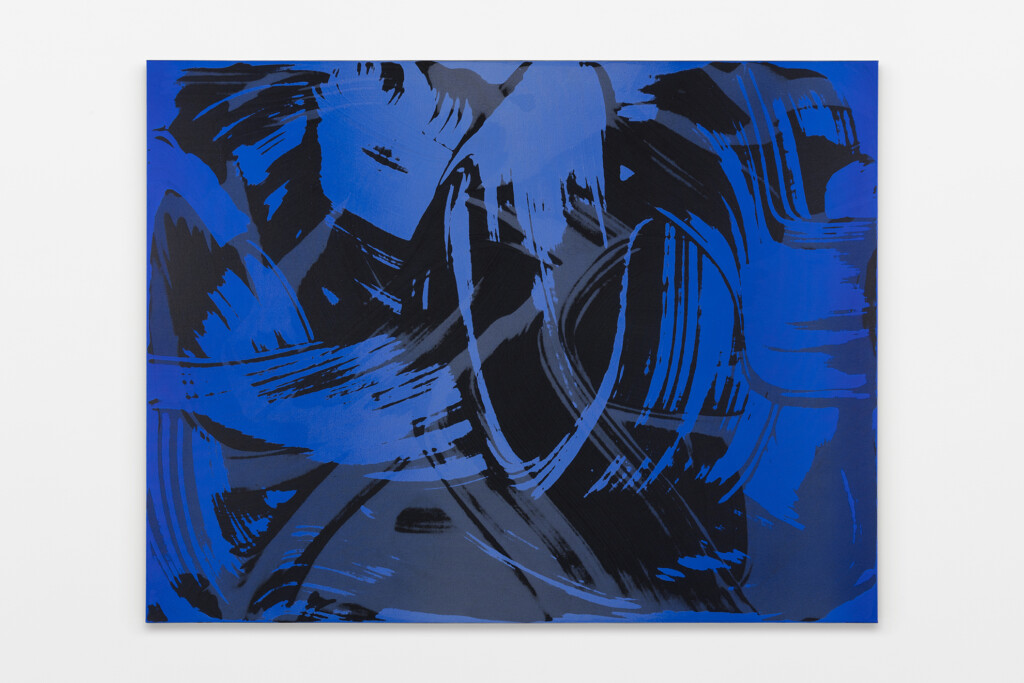

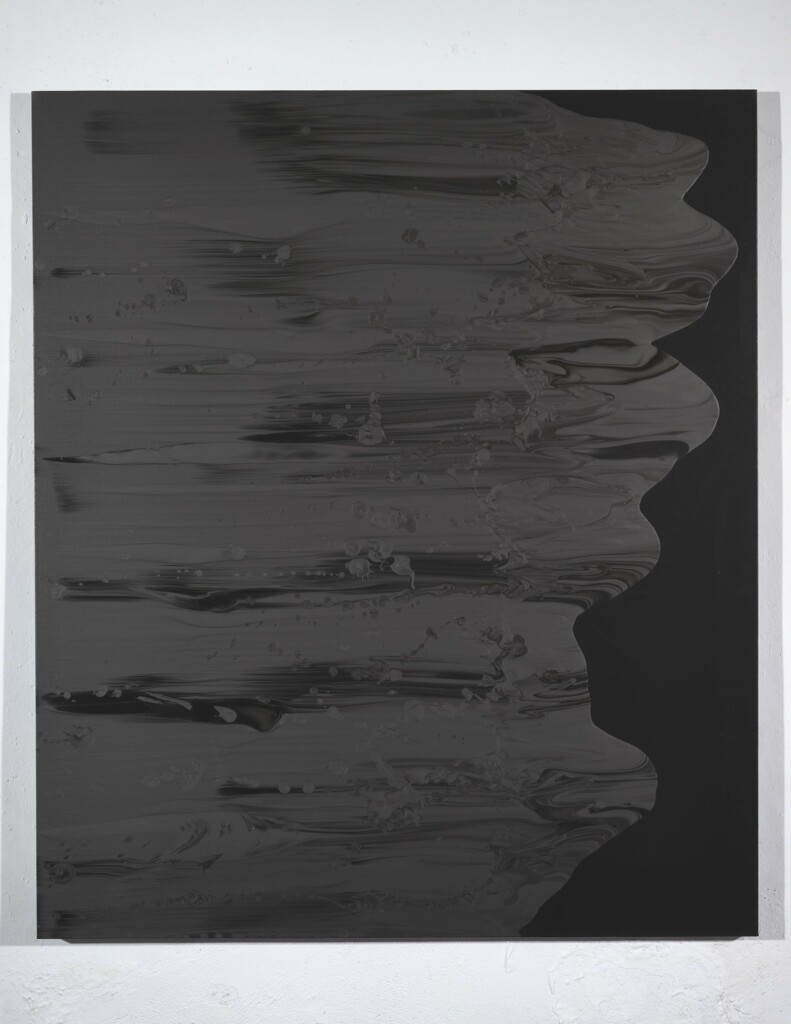

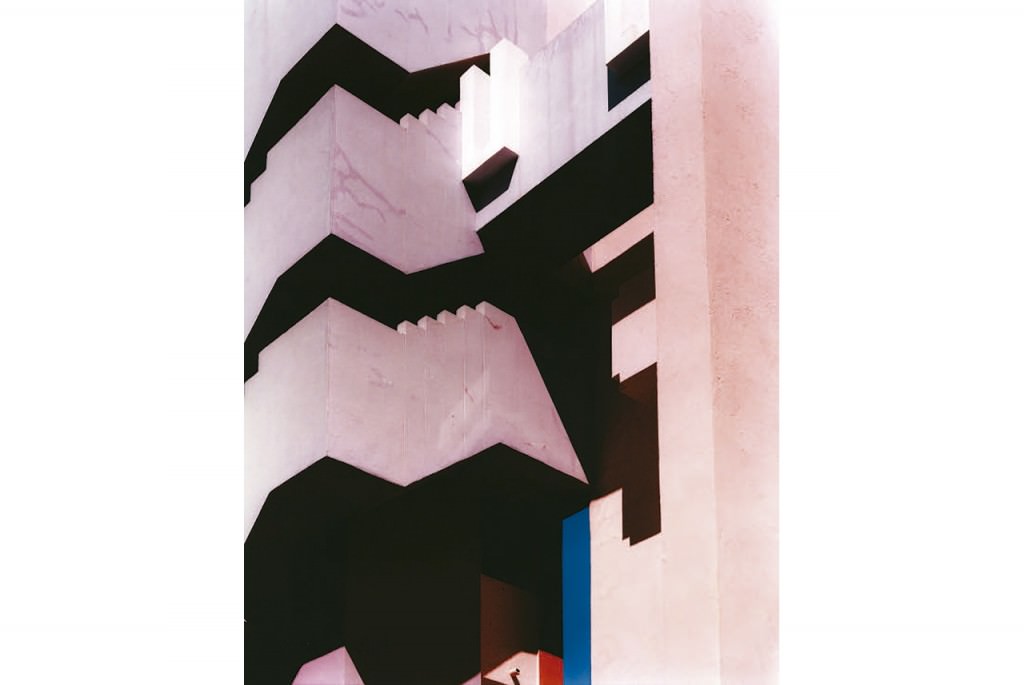

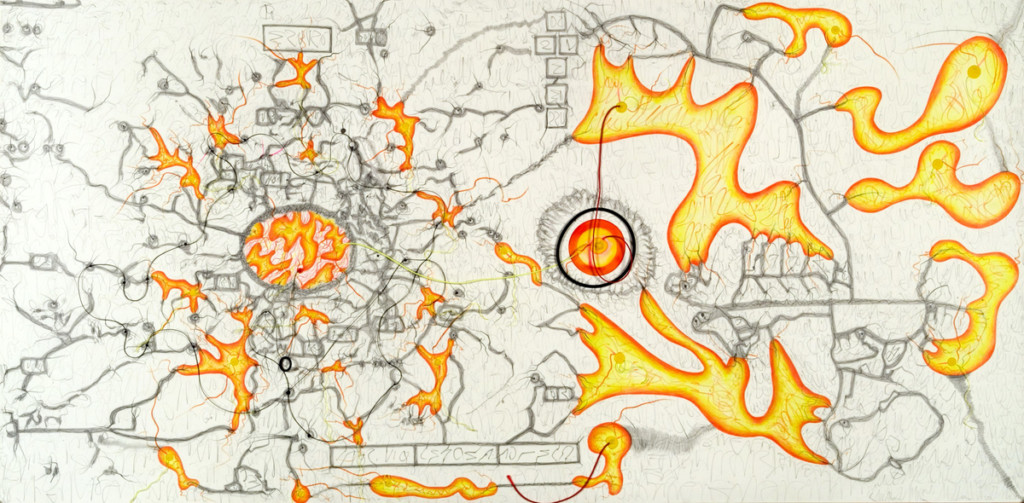

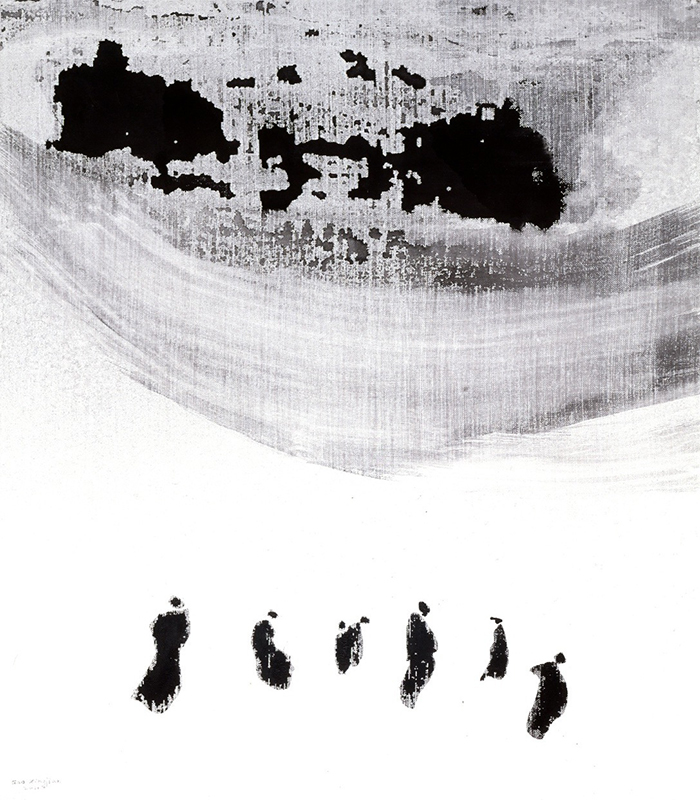

One of the exhibiting galleries was SENDA, who defines itself as a microscopic gallery. SENDA found a way, in the midst of the pandemic, to form an alliance with the PUSHKIN STATE MUSEUM OF FINE ARTS in Moscow and produce together an online art project entitled TEDIUM.

We have the privilege of interviewing Carlos Durán, the owner and founder of SENDA since 1991.

It is known that sales in on-site galleries fell by 36% during the first half of 2020, whereas online sales have grown by 37% during the same period. Are we moving towards a future of “Instagram Galleries”?

Not quite. The lockdown meant a drop in on-site sales and we all focused on boosting our activity in online networks and other platforms aiming to access other audiences. It was then confirmed that these tools were extremely useful. But we also confirmed that they were never going to replace physical space of a gallery. Absolutely. When the degree of confinement was relaxed, we realized that what people really wanted was to interact with art in person. That said, we have learned that the online world is an essential and wonderful sales channel, and we are going to dedicate a higher energy to it than what we were dedicating before.

According to the American consulting firm Cerulli Associates, Generation X, those born between 1965 and 1980 will inherit from their parents and grandparents $ 68 billion in the next ten years, including an important proportion of pieces of art. Do you think that the new generations, educated in the Internet era, will also inherit the family culture and will continue to enjoy and invest in art?

I am optimistic in this regard, it makes sense. For two reasons: first, because they are more educated and cultivated people. They have traveled more than previous generations. And second, because art has become, more than ever, a guaranteed asset and an element of enjoyment. Never before has there been a greater audience and interest in art.

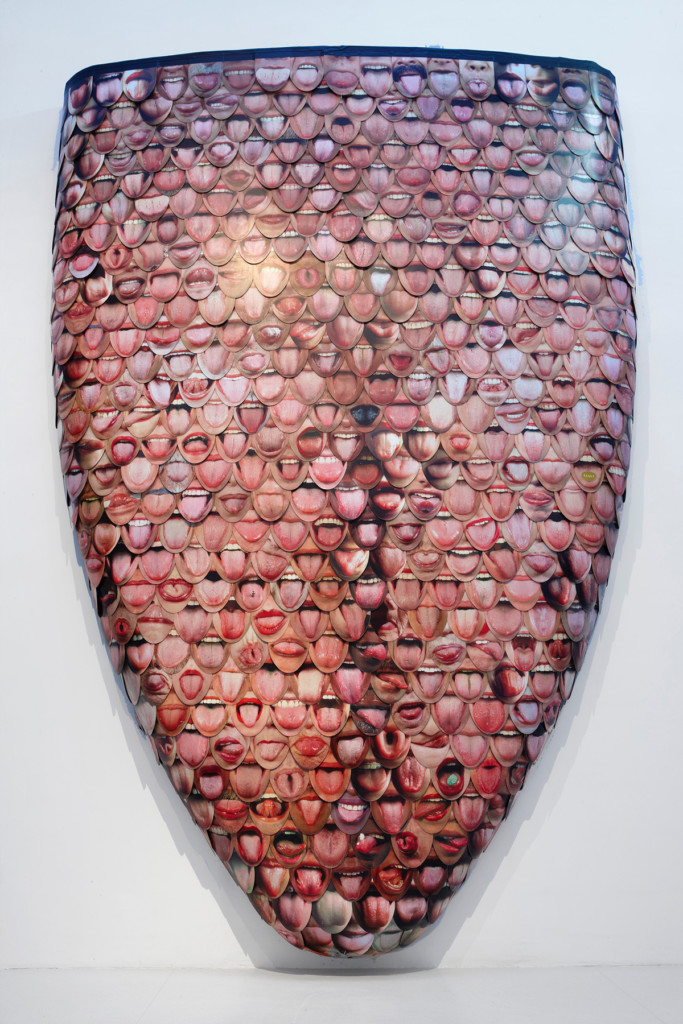

Spanish artists represent around 1% of world art sales. Do you think they do not know how to sell internationally?

Spain is a permanently creative country. For the last four centuries, Spain has gifted the world with a gigantic cast of great creators. It is true that at this moment we are perhaps going through the worst historical moment of promoting our own art, which means that Spain is a country that has created, that has great creators, but currently does not know how to take advantage of all this.

Representing 1% of global sales is a gigantic imbalance, indicating that there is a lot of rough diamonds to be discovered.

How did Carlos Durán manage to ally with the PUSHKIN STATE MUSEUM OF FINE ARTS in Moscow?

A previous collaborative relationship in a seminar we did in Moscow paved the way. At the very beginning of the confinement, we started a project on Instagram, a campaign entitled Wellcome Home, a window where artists from all over the world have been explaining and sharing their experiences during the lockdown period. We kept the dialogue alive regarding the concerns that we all had at that time, and to demonstrate that those same concerns were found in any corner of the world, whether we were creators, audience, artists, collectors or simply followers of the art world. Concerns were identical everywhere. This participatory project was observed by the PUSHKIN MUSEUM and they invited us to jointly develop a project on the Museum’s online platforms. This also answers the previous question: If there is marketing and knowledge, there is international interest.

European banks no longer show interest in their customers’ cash on hand. Interest on deposits has been reduced to 0% and banks begin to charge commissions for guarding immobile money. Do you think it is a good opportunity for savers to be interested in investing in art as a refuge for capital?

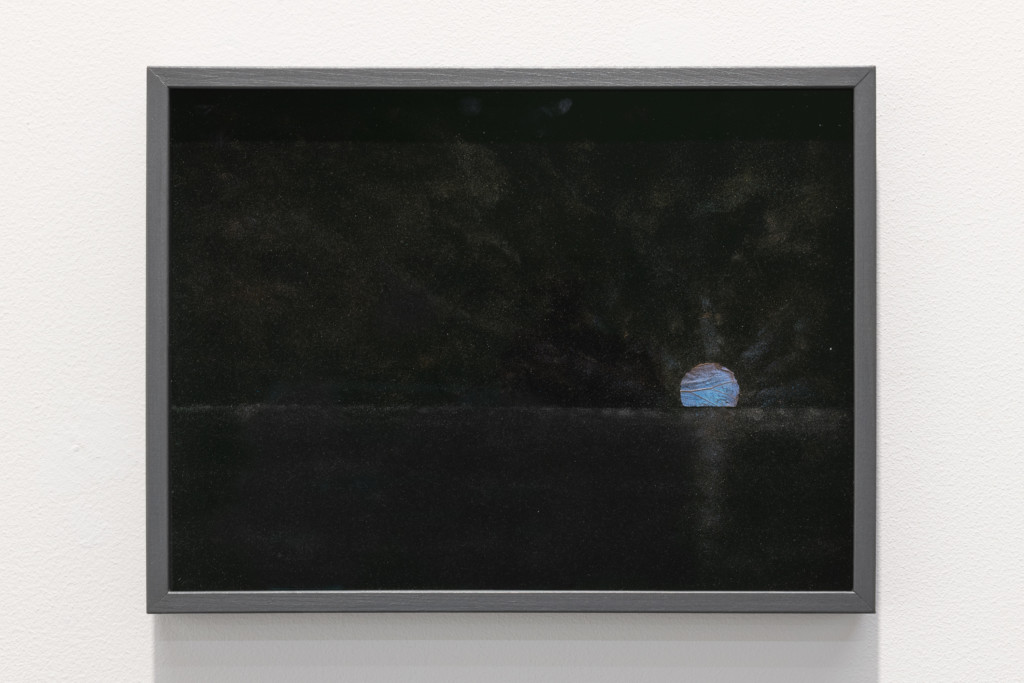

Art experiences a process of transparency where the market has become something much more solid. The group of artists, known as the BlueChips, are considered safe assets for investment. Consequently, the saver, the art lover, and the great collector, who are speculators looking for profits in assets, are getting into the game in addition to the knowledgeable buyer.

Historically, it has been proven, even during the different world wars and economic crises, that art is a good place to secure capital. And now more than ever, because market transparency is clearly higher than at any other time in history.

Some gallery owners consider that putting a price on art works is a delicate and even poisoned matter, and they are reluctant to make it public. Does Carlos Durán think it is a good business strategy?

It is true that not showing the price publicly gives you a conversation starter with a potential interested party. But on the contrary, it also sends a message of little confidence from which I try to fly away. Personally, I think that transparency gives confidence. So, we clearly bet on removing the reservations to keep the prices hidden.

How would you rate the investment in art? Savings, investment, speculation, refuge, or enjoyment...

I don’t think these concepts are exclusive. The main objective should be enjoyment, without a doubt. From a certain amount of money, it should be considered an investment, which to some extent is a saving system. In certain conditions, saving is a form of protection. Speculation, also partly generated by the market, is something we always try to avoid. Anyone who enters the art world for speculative reasons somehow perverts the reality of the market. Thus, personally it is the least interesting of all the profiles.

If you had, right now, $ 1 million to invest in art, what would you buy?

I would buy what I really like. I would look for artists with already developed careers and divide the investment into parts.

The first would be a guaranteed investment: minor works, but very characteristic, by great authors. An example could be a drawing by Picasso, because $ 1 million is not enough to buy any Picasso canvas. It should be a drawing that contains all the painter’s features. Perhaps it would cost around € 200,000.

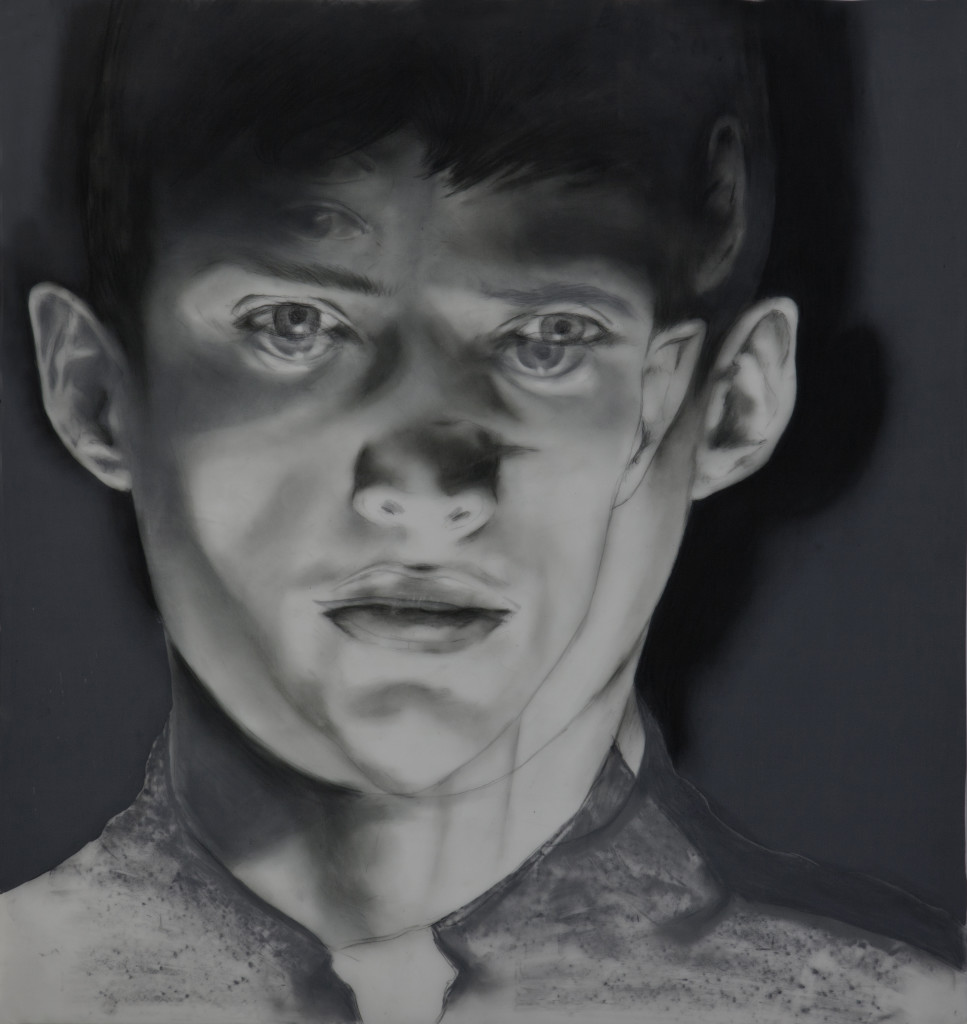

Then I would look for artists who are in the middle of their careers, with international projection, and who have already shown their contribution to the art history of their generation. Artists who generally have a very positive quality / price ratio and are about to upgrade.

I would personally reserve a smaller percentage for emerging creators, but I would run away from the speculative young artist. When young artists who are starting seem to stand out it is when the market tends to be perverted, almost always.